This question is always a topic of discussion among the various actors of and around the company, from the entrepreneur to the investment bankers, going through lawyers, auditors, accountants etc…

Many of these actors, basing their argument on the listing requirements, believe and will want the entrepreneur to believe the issuing company has to meet several internal criterias before going public:

- The issuer must have significant revenue.

- The issuer should preferably be profitable or at least cash flow positive.

- The issuer should have a strong and stable growth.

- The issuer must have two years audited balance sheet.

This is especially true when one talks with investment bankers who attempt to reduce their liability as much as possible and rightly so.

The truth is much more complex and less pleasant: it depends on both internal factors like the ones hereabove listed and external factors such as:

- is the market the issuing company dealing with a trendy one?

- have other companies with similar business models been successful?

Strangely, Wall Street generally does not like pioneers.An old adage on Wall Street says “Pioneers die with arrows in the back.”

What does Wall Street like then?

Companies with proven business models in a well-known industry. That is the reason why a hamburger chain will easily raise money despite the fact there are hundreds out there.

When is a company ready for an IPO then?

My answer is different from what you will hear and read on the market and I have no doubt many professionals will criticize me for it, but I honestly believe it is the Truth:

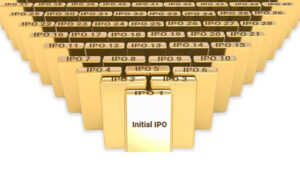

Knock at the door of investment banks regularly every year.Ask them to raise money for your company or for a new project your company is pursuing. Keep asking and insisting until someone tells you it is possible and shows interest in it. Write down objections and problems raised by each interlocutor and try to correct them.

Change interlocutor yearly but keep even a distant contact with each interlocutor. Keep them informed of the progress of the issuing company. Remember they actually are the market that will buy the securities sold by the company when it will make its initial public offering.

Some companies can go public and be an empty box, although many critics will tell you the contrary or assess it used to be so but is no longer the case.

When one master of Wall Street will want it, the company will go public. If you do not know them or how to convince them, call me.

It will be a pleasure and an honor for me to be your pathfinder.