Intellectual Property Securities Corporation is a Delaware company specialized in the securitization of movie rights, copyrights, authoring and neighbouring rights that allow authors, artists, inventors or other IP holders to raise money from the securities markets by selling or licensing their Intellectual Property rights.

First, one could legitimately wonder what is an IPO Incubator as it did not exist before EverGrowth. An IPO Incubator is a company financing the costs of an IPO by paying the IPO expenses directly to the securities issuer’s suppliers, without relying on the management team of the issuer, thereby partially following the model of a construction loan. The difference is that PO Incubator gets equity and takes a real financial risk. If the IPO is not completed, without any issuer’s or its management fault, the IPO Incubator can lose its capital or remain locked in its participation in the issuer without any possibility of exit.

What is an IPO Cascade ?

An IPO Cascade is created by the fact that an issuer of equity stock, unable to finance its own IPO, commits to use a portion of its proceeds in case of success of its own IPO, to finance one or more issuers in the same situation. Thereby, a domino effect is generated, enabling other IPO transactions to be financed.

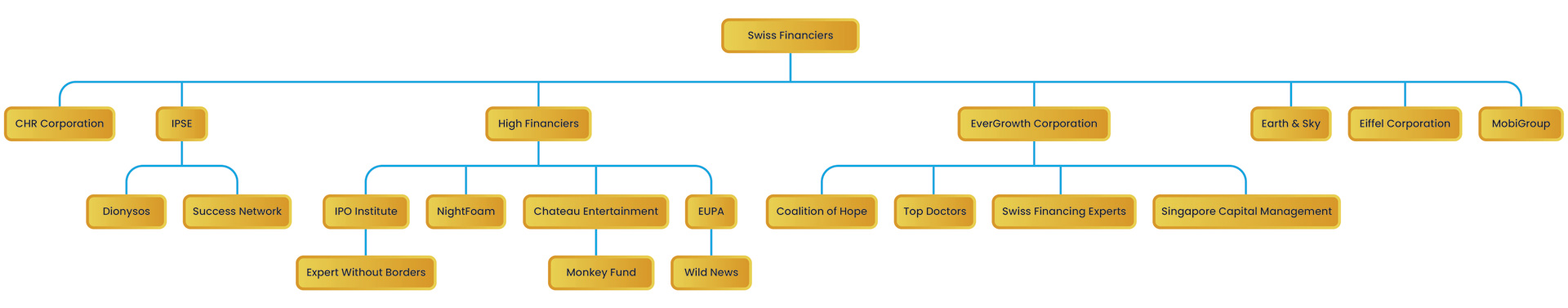

Swiss Financiers Inc.

CHR Corporation

IPSE

High Financiers

EverGrowth Corporation

Earth & Sky

Eiffel Corporation

MobiGroup

Dionysos

Success Network

IPO Institute

Night Foam

Chateau Entertainment

EUPA

Coalition of Hope

Top Doctors

Swiss Financing Experts

Singapore Capital Management

Experts Without Borders

Monkey Fund

Wild News

The Future of the Investment Bank through Multiverse & Artificial Intelligence:

Perpetual Charity Corporation is a financial company attempting to combine Charity with Investment & Business launched by the Wall Street Community.

Perpetual Charity Corporation openly called the communities of Wall Street, Broadway, Hollywood and Silicon Valley and will make more calls to World Celebrities in order to raise the attention and consciousness necessary to its fundraising success. Perpetual Charity Corporation will offer:

- a return to the investor

- a financing to the most competitive charities

- an integration of charity into the daily course of business

- a free analysis of every major charitable organization to help donator choose

- a rating agency evaluating every major charitable organization’s performance

FINANCING

Secured IPOs in challenging times:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Monkey Fund is an expense fund managed by a chimp. The chimp was trained to throw a tennis ball covered of Velcro on a large touch screen covered of Velcro as well, on which rectangle surfaces drawings define a corporate stock. When a stock is first touched by the ball, the fund buys it. When a stock is touched again by the ball, the fund sells it. There is no human correction or interaction.

The Wall Street Awards

a ceremony of awards to the best actors of Wall Street the first day of the Conference as well as Mr. & Ms. Wall Street.

The IPO Awards

a ceremony rewarding the best IPOs of all times and the best recent or last year IPOs, as well as the most appealing future IPO the second day of the Conference as well as Mr. & Ms. IPO.

The Sexiest IPO Competition

The Most Appealing future IPO will be a competition of companies where people will vote by calling a toll paying 900 phone number ($1 to $5). The winning company having the largest number of calls will receive the amount collected by the votes and will be submitted for underwriting to the largest underwriters of Wall Street.