SHARES OF STOCK ISSUES:

I. GENERAL RULES AND CLASSIC FINANCING METHODS

An entrepreneur or a company is looking to raise capital to undertake a project.

When Greenberg, Hornblower, Deschenaux & Partners helps to incorporate, restructure, or protect a company, it transforms it into a “Reporting Issuer”, “Issuing Company” or “Issuer”, that is to say, a company legally capable of issuing shares on the capital market.

Greenberg, Hornblower, Deschenaux & Partners will help the Entrepreneur to keep control on his company, while converting it into an Issuer, and to guide its search for capital.

It is our priority to guide you to pass safely though the labyrinth of legal regulations and financial activities, in order to allow you to maximize the potential of your business.

This guide will help you discover the processes and the actors on the financial markets, and how Greenberg, Hornblower, Deschenaux & Partners can benefit you.

Every Reporting Issuer is first advised by our Team. We will coordinate the follow-up of the dossier and the creation of a multimedia presentation.

In the case of public distribution, namely after an IPO, Greenberg, Hornblower, Deschenaux & Partners can still involve a regulator of the market to consolidate the securities, or the valuation of the Issuer.

Once the necessary procedures have been followed, Greenberg, Hornblower, Deschenaux & Partners assists the Issuer in the registration of the Issue with the relevant authorities and in particular with the securities market authorities.

Then the Issuer releases the shares according to a plan created by Greenberg, Hornblower, Deschenaux & Partners in coordination with the Investment bankers and in compliance with the relevant declarations being made to the authorities.

The Investment bankers will publicize this offer for shares through roadshows and their sales department will then sell the shares on the capital market through their network of brokers, agents and investment funds.

The IT department is responsible for updating the site deschenaux.com, so the Issuer and brokers have a direct follow-up of the events and sales regarding the securities.

Three outcomes can be foreseen from these operations:

- All of the securities offered are sold, and the resulting proceeds are channeled to the Issuer minus a commission for the Investment bankers and their distribution channels.

- All of the securities offered are not sold and the resulting proceeds are sufficient to finance a part of the project. In this case the investors are notified (unless it is a continuous closing operation), and can decide whether or not to withdraw their investment in the project.

- All of the securities are not sold and the resulting revenue is insufficient to finance any part of the project. In this case the investors are reimbursed and the fundraising is cancelled.

The financial markets are composed of the following actors:

- The Public Stock Markets.

- The Unquoted Markets and the OTC (Over-the-Counter) Markets.

- The Private Markets.

- The Institutional Markets.

Greenberg, Hornblower, Deschenaux & Partners will describe all of these markets and show you how access to them can fulfill the requirements of your company.

II. PREPARATION OF A PRIVATE OFFERING OF SECURITIES

The preparation of a private offering is an operation in which a company transforms itself into an Issuer. This transformation necessitates a number of amendments to the legal structure and the internal organs of the company. These changes then have to be notified to the relevant authorities overseeing the capital markets, and other capital market operators.

Occasionally the preparation for a private offering begins with incorporation of the company, or if necessary, with the registration of relevant trademarks consolidating the incorporation. In the case where the company already exists, it begins with the amendment to its legal structure.

In the majority of cases the preparation of a securities issue ends with the creation of a document entitled the “Private Offering Memorandum”. This document is the principal source of information on the activities of the business, and is an indispensable document for potential investors in the Issuing Company.

At this stage in the preparation of a securities issue, the role of Greenberg, Hornblower, Deschenaux & Partners as a financial guide is indispensable to the company. Greenberg, Hornblower, Deschenaux & Partners not only undertakes the transformation of the company into an “Issuer”, but also undertakes all the necessary internal and external due diligence of the company, which has to be done in order to create the due diligence file. The “Due Diligence File” is a set of documents and evidences of all kinds which prove the statements made in the disclosure document such as the Private Offering Memorandum. Although the creation of the Private Offering Memorandum is primarily the task of the issuing company, Greenberg, Hornblower, Deschenaux & Partners can provide its own format which has been legally verified for compliance with the relevant legal norms. Furthermore, Greenberg, Hornblower, Deschenaux & Partners can point out any strengths, weaknesses and associated risks in the memorandum. As a financial and legal advisor, Greenberg, Hornblower, Deschenaux & Partners wants to protect the Issuer, its board of directors, and its management, against any actors on the capital markets.

Whatever the type of securities to be issued, the quality, security and the success of a private offering is in direct correlation with its preparation. It is a lot less important to undertake a lot of publicity for a securities issue than to prepare it well, since word of mouth will frequently point investors in the direction of a well-prepared and serious offer.

Furthermore, it is also important that the issuing company and its board realize that the preparation of a private offering is not only a laborious and costly task, but that it also offers the possibility for the management to cast a critical eye over the proposed future operations of the company, before any of these costs have been incurred. The opportunity to check the coherence of a business plan and the proposed decisional structure can often avoid unforeseen disasters, as well as radically increases the chance of success.

The necessity to undertake strict due diligence also forces the Issuer to address its market, and its competitors, which in turn leads to new business ideas on how to develop markets and products.

In conclusion, the culture of our business considers that the preparation of a private offering is an act of management, marketing, and selling necessary for the success of the business, beyond the execution of the issue itself. A correctly drafted Private Offering Memorandum is a very important document for the company in administering its relations with its bankers, auditors, strategic partners and tax authorities, whose work (and, therefore, costs) will be considerably reduced by referral to this document.

III. PRIVATE OFFERING

A Private Offering is undertaken by the issuance of securities or bonds without accessing the public market. Most usually these securities are offered for sale on a private basis to accredited investors by way of a “ Private Offering”.

According to the American definition of the term, “accredited investors” generally refers either to individuals or companies whose primary activity is related to the capital market (broker, banker, pension fund etc.), qualified individuals (attorney, accountant, officers, directors etc.), or individuals who have a meaningful net worth or significant annual income for the present and past two years, and have significant investment experience, and are able to make rational investment decisions based on adequate and relevant information.

THE DISTRIBUTION OF A PRIVATE OFFERING

When one speaks of undertaking a Private Offering, one is considering the simple fact of distributing securities through a private securities offering.

This process implies not only knowledge and relationships with the financial community, but also the credibility necessary to inspire them to read the Private Offering Memorandum. It also implies that your financial guide has expertise and access to a powerful network of banks, investment bankers, funds, financiers, investors, brokers, traders and media people as well as knowledge of the legal and commercial constraints relating to the sale of securities around the world.

Greenberg, Hornblower, Deschenaux & Partners supports such an international network throughout the world, particularly in the major financial centers. This network has a solid experience in undertaking the sale of securities through Private Offerings.

Although syndicates are usually found in the world of public offerings, they are increasingly used in the context of Private Offerings, in a simplified structure.

Greenberg, Hornblower, Deschenaux & Partners having many relationships with the actors of the capital market, it is not uncommon for us to help a company in financial trouble to bear the costs of the offering by direct and private investment, with issuance. However, we restrict this support to the context of financing an offering to protect both the investor and the Issuer.

TRADITIONAL PRIVATE INVESTMENT

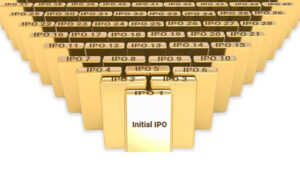

The most common type of private investment is the Initial Private Offering. This can take the form of either “seed capital” or “first round financing”. By definition, these investments are used to aid the newly founded start –up companies in need of finance for its initial operations. These investments are usually provided to support the company until it is able to generate revenues.

When the Issuer has proven that its business model is viable and has successfully negotiated the start-up phase, the company moves on to its second phase, called the “development phase”. At this stage, it is normal to arrange a second investment, called the “second round”. The risk to the investor is considerably lower than at the start -up phase because the Issuer has demonstrated its business model. Consequently, this round is more costly to the investor as the investment has a lower risk than during the first investment round. And since the company is closer to its stock market floatation, the return on investment and profit are more likely to be realized.

MEZZANINE ROUND

Occasionally the Issuer is unable to finance its floatation due to a lack of funds. In these cases it is necessary to undertake a final round called the “mezzanine round”. Due to the even lower risk involved in this case, this investment is usually made using convertible bonds which can be converted into equity following the successful market floatation. Due to their investment characteristics, this type of investment is a favorite of institutional investors and professional underwriters.

PRIVATE PLACEMENTS FOR PUBLIC COMPANIES

Once the Issuer has proven the viability of its business and achieved the start-up stage, there is the development stage, also referred to as the second stage. Under normal conditions, this second offering is more costly for the investor as the risk is considerably lower than in the initial private offering and the company is closer to its listing, its break-even point or, in a general perspective, it has improved significantly towards its objectives.

This type of operation is most used in situations where the market capitalization of the company is small (“small cap” sector). However, these operations usually contain a number of very tight restrictions, notably that the price of additional shares will not be lower than 15% less than the market valuation of the shares, and there are restrictions on their future transfer. This means that there is limited transferability of these securities for a period of up to two years following the operation.